Understanding Bankroll Management

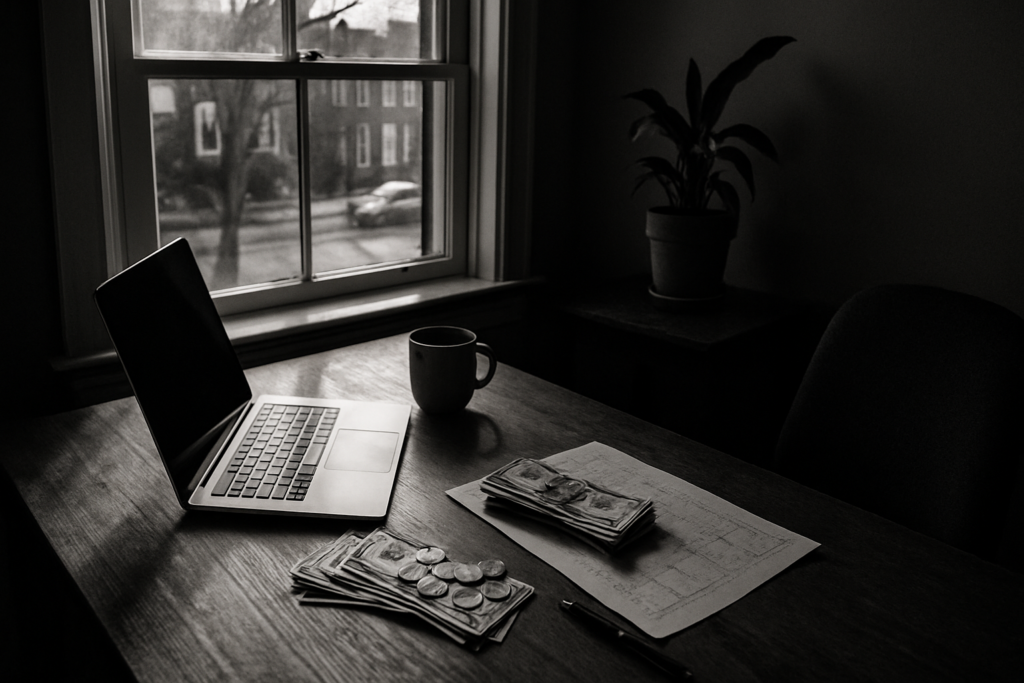

Bankroll management acts as the foundation of a sustainable gambling approach. Establishing a dedicated gambling budget prevents the mingling of personal finances and gaming funds, ensuring clear spending boundaries. For both beginners and seasoned players, setting a dedicated budget safeguards against unforeseen financial strain.

Tracking expenditures proves indispensable in identifying spending habits. By keeping accurate records of wins and losses, I can adjust my strategy and improve long-term outcomes. Consistent tracking alleviates the potential for unexpected setbacks and maintains financial control.

Setting loss limits helps mitigate emotional decision-making. If I acknowledge my limit for losses, I minimize the risk of chasing losses and making impulsive bets. This restraint guards my bankroll and maintains my focus on informed choices.

Diversifying bets ensures balanced risk management. By spreading wagers across various games or outcomes, I can reduce exposure to any single game’s volatility. This approach augments the potential for lasting success and helps me stay engaged without risking significant portions of my bankroll.

Mistake 1: Not Setting a Budget

Ignoring a gambling budget poses significant risks to financial stability. A structured approach to funds ensures a sustainable gaming experience.

The Importance of a Budget

A dedicated budget is crucial in separating gaming funds from personal finances. It prevents overspending by providing clear boundaries. Without a budget, emotional decisions can lead to chasing losses and ultimately depleting funds. The discipline of maintaining a budget promotes responsible gaming and allows for better control over financial commitments.

Tips to Set a Realistic Budget

Setting a realistic budget involves assessing disposable income while considering financial obligations. First, identify a comfortable amount to allocate without affecting essential expenses. Second, regularly review and adjust the budget based on changes in income or expenses. Lastly, incorporate a tracking system to monitor spending, ensuring adherence to the budget limits and identifying patterns in betting behavior.

Mistake 2: Chasing Losses

Chasing losses occurs when a gambler increases bets after losing, hoping to regain lost money quickly. This approach poses several risks to one’s financial and emotional well-being.

Why Chasing Losses Is Dangerous

Chasing losses often exacerbates financial troubles by leading to more significant debt. When emotion overrides strategy, gamblers tend to lose sight of their bankroll limits and risk more than planned. This behavior can snowball, causing further losses and heightening stress. According to a study by the National Council on Problem Gambling, 23% of people reported worsening financial conditions due to impulsive behavior like chasing losses.

How to Stay Disciplined

- Maintaining discipline involves setting strict boundaries and adhering to them.

- Establishing a stop-loss limit helps prevent further losses once a predetermined amount is spent.

- Employing a cool-off period allows time to regain composure and avoid impulsive decisions.

- Implementing self-exclusion tools can also aid discipline, limiting access to gambling platforms during critical times.

- Additionally, monitoring spending tactics ensures alignment with the established bankroll strategy.

Mistake 3: Lack of Record Keeping

Not maintaining detailed records of your gambling activities often leads to inefficiencies in bankroll management. Proper tracking offers numerous benefits that safeguard your finances and improve your gaming outcomes.

Benefits of Tracking Your Bankroll

Regular record keeping provides clarity regarding your gambling habits. It allows you to:

- analyze spending patterns

- identify successful strategies

- pinpoint areas

where you might be overspending. This insight helps make informed decisions on adjusting your game plan to optimize performance. By keeping thorough records, you stay accountable and disciplined, reducing the likelihood of impulsive bets or emotional judgments. A consistent tracking system also assists in setting realistic profit goals and loss limits.

Tools and Strategies for Effective Record Keeping

Several tools enhance record-keeping efficiency. Spreadsheet software like Microsoft Excel or Google Sheets offers customizable templates to document wins, losses, and betting history accurately. Online banking apps can help aggregate and categorize your transactions. For a more detailed analysis, gambling-specific apps provide metrics designed to record bets across different games and track overall profit and loss. Establishing a routine, such as logging data after each session, ensures consistency and reliability in managing your bankroll.

Mistake 4: Ignoring Stakes

Ignoring stakes often leads to playing above one’s means. This practice jeopardizes financial stability and increases stress.

Impact of Playing Above Your Means

Playing above your means means risking more money than your bankroll can support. This can quickly deplete funds, leading to a halt in gambling activities before achieving any substantial wins. It can also induce panic, prompting rash decisions in an attempt to recover losses. Repeatedly gambling in this manner not only strains finances but also impacts emotional well-being, causing frustration and anxiety.

Guidelines for Choosing Appropriate Stakes

Align stakes with your bankroll size to promote sustainability. I recommend setting a maximum bet percentage relative to your total bankroll, such as 1-2%, to minimize risk. Evaluate the volatility of games you engage in; high-risk games may require lower stakes. Consistently assess your financial position before adjusting stakes, and use a tracking system to monitor performance. Prioritizing manageable stakes ensures longevity in gambling endeavors and reduces the likelihood of significant financial setbacks.

Mistake 5: Emotional Spending

Emotional spending emerges when impulses, rather than logic, dictate gambling decisions. It can deplete bankrolls swiftly.

Recognizing Emotional Spending Patterns

Recognizing patterns, such as betting more during stressful periods or making impulsive bets after losses, helps identify emotional spending. If my gambling frequency increases after personal setbacks or I find myself justifying irrational bets, it indicates emotional expenditure. Monitoring these instances highlights inconsistencies in decision-making.

Strategies to Maintain Emotional Control

Maintaining emotional control requires disciplined strategies. I can set predefined session goals to mitigate impulsivity. Implementing strict time limits and adhering to stop-win goals ensures I quit while ahead rather than chasing further gains. Engaging in mindfulness practices, such as deep breathing or taking breaks, reduces stress-related betting triggers. Robust self-assessment routines enable me to distinguish between excitement-driven and rational decisions, promoting a stable gambling environment.

Bessie Christmannero

Founder

Bessie Christmannero is the pioneering founder of Prime Gambling Way, a platform designed to revolutionize the gambling experience. With over a decade of experience in the gambling industry, Bessie has been at the forefront of delivering innovative strategies and expert betting advice. Her deep knowledge of industry trends, combined with a relentless drive to educate and empower bettors, has shaped Prime Gambling Way into a trusted authority. Bessie’s vision is rooted in the belief that informed decisions lead to successful outcomes, and she strives to make professional insights accessible to everyone, from seasoned gamblers to newcomers.

Bessie Christmannero

Founder

Bessie Christmannero is the pioneering founder of Prime Gambling Way, a platform designed to revolutionize the gambling experience. With over a decade of experience in the gambling industry, Bessie has been at the forefront of delivering innovative strategies and expert betting advice. Her deep knowledge of industry trends, combined with a relentless drive to educate and empower bettors, has shaped Prime Gambling Way into a trusted authority. Bessie’s vision is rooted in the belief that informed decisions lead to successful outcomes, and she strives to make professional insights accessible to everyone, from seasoned gamblers to newcomers.